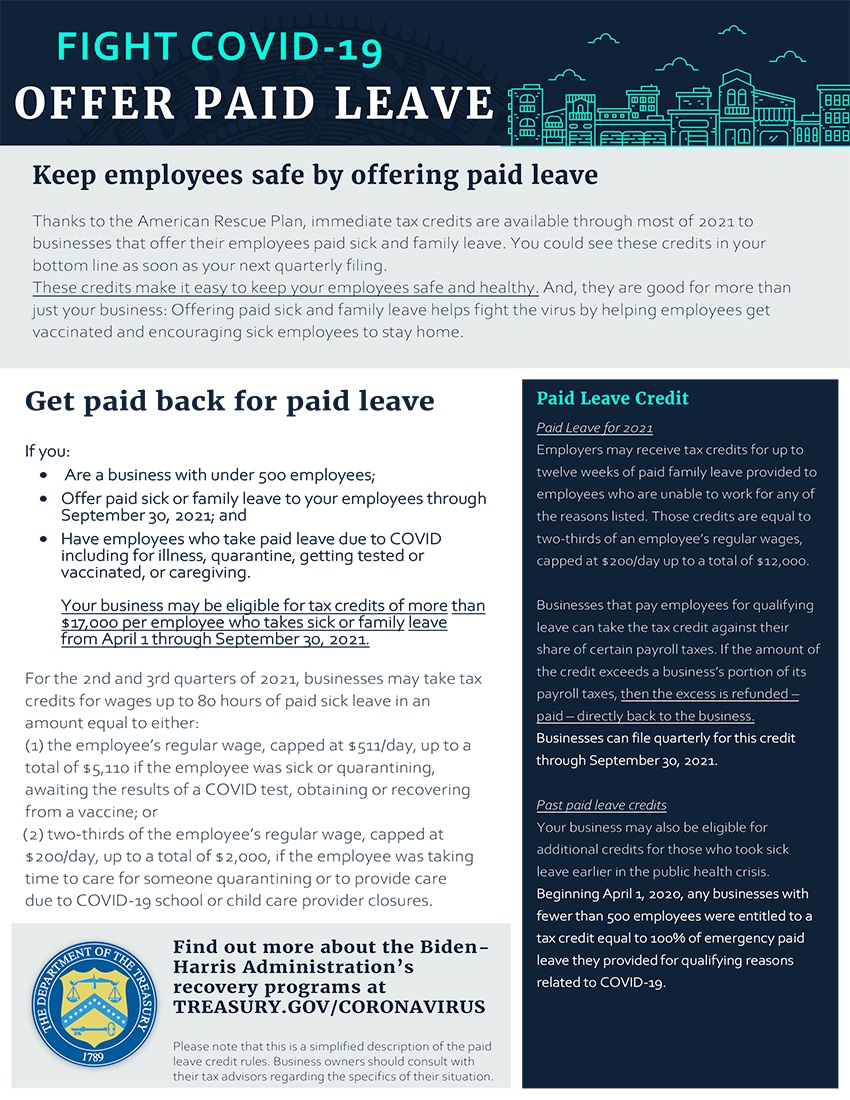

Paid Leave for 2021

Employers may receive tax credits for up to twelve weeks of paid family leave provided to employees who are unable to work for any of the reasons listed. Those credits are equal to two-thirds of an employee’s regular wages, capped at $200/day up to a total of $12,000.

Employers may receive tax credits for up to twelve weeks of paid family leave provided to employees who are unable to work for any of the reasons listed. Those credits are equal to two-thirds of an employee’s regular wages, capped at $200/day up to a total of $12,000.

Businesses that pay employees for qualifying leave can take the tax credit against their share of certain payroll taxes. If the amount of the credit exceeds a business’s portion of its payroll taxes, then the excess is refunded – paid – directly back to the business. Businesses can file quarterly for this credit through September 30, 2021.

Past paid leave credits

Your business may also be eligible for additional credits for those who took sick leave earlier in the public health crisis. Beginning April 1, 2020, any businesses with fewer than 500 employees were entitled to a tax credit equal to 100% of emergency paid leave they provided for qualifying reasons related to COVID-19.